| Click here to view this e-mail in your browser |

|

|||

| Business case studies | No 197 - 01.12.2017 |

|

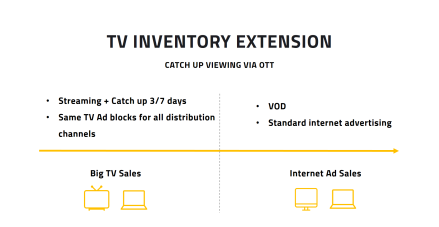

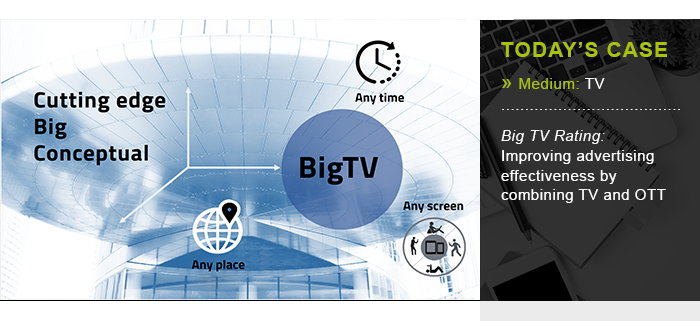

How do you vastly improve the way sales houses manage their inventory, agencies plan marketing campaigns and advertisers gain a better understanding of their customers in a rapidly changing landscape? With this challenge in mind, Russia’s leading TV sales house NAA (National Advertising Alliance) joined forces with media research company Mediascope to launch Big TV Rating - with Gazprom-media holding as the first client. This week’s egtabite features this innovative product which allows the selling and buying of over-the-top inventory (OTT) as a part of regular television inventory. The NAA firmly believes that their Big TV Rating will increase adspend and contribute to positioning TV as the most effective advertising medium on their market. The best of both worlds Big TV Rating combines TV and Internet GRPs, in such a way that the client pays for GRPs regardless of whether the content is viewed on a television set or a computer screen. Until recently OTT TV viewing remained an unaccounted and unreported part of TV viewing in Russia. This meant unreported ad contacts in marketing campaigns and, as a consequence, a loss in audience and budget for broadcasters. With this combined approach, the NAA hopes to respond to specific changes on the Russian market. Firstly, the rising audience fragmentation due to an increasing number of TV channels (7 TV channels on average in 2000, 63 in 2016) as well as the increase in available screens for a viewer (1,3 screens on average in 2000 and 4,2 in 2016). The audience fragmentation results in a cost increase for TV ad campaigns with the same reach targets. In 2014, an 80% reach campaign on target group 18-44 required 580 GRPs, in 2017 this takes as many as 990 GRPs, using the same TV channel mix. The second challenge the Russian TV industry is facing, as are other markets, is the distinct decline in viewing on a TV set in the 12-44 age group - Big TV Rating deals with the image problem TV is facing by showing business partners that TV is digital. Lastly, the fact that OTT TV viewing has become a common practice; it is estimated that 22% of all TV viewing in the age group 18-24 occurs via over-the-top services. In the age group 35-54, this figure is cut in half (~11%).

How is Big TV Rating reported? TV content intended for OTT distribution is tagged (this requires the collaboration of TV channels). Tagged content viewing (live, VOSDAL, Playback) is then monitored thanks to MediaScope’s Internet panel (12 500 panelists). The data is complemented by a cross-panel (2 500 panelists) using VirtualMeter installed on desktop devices and by MediaScope’s TAM panel (13 500 panelists). The combined data is then used to generate the Big TV Rating. What Big TV Rating brings to the TV ad industry Thanks to Big TV Rating, TV channels, advertisers and agencies not only gain a better understanding of how many viewers consume TV content across different platforms and in which manner they consume, but they also get a higher reach for their ad campaigns. For example, TV series “Patsanki” (Tomboys) on channel “Pyatnitsa!” with Big TV Rating gets a 30% audience increase (target group 14-44), sitcom “Olga” (TNT channel) grows by 19%, dance competition TV show “Tantsy” (TNT channel) by 13% and reality-show “Dom-2” – by 12%. The quality of TV inventory improves: the 2% OTT TV inventory improves the quality of 98% of the inventory and in specific demographics the affinity even doubles. What’s next? The next step in developing Big TV Rating will be to include TV viewing on mobile devices - which is estimated to double OTT TV inventory - and to add TV consumption in viewers’ second home.

|

|

| egta - 22, Rue des Comédiens, boîte 4 - 1000 Brussels - T: + 32 2 290 31 31 - www.egta.com |